Mutual Fund Calculator

SWP Mutual Fund Calculator In the world of investing, mutual funds have emerged as one of the most popular investment vehicles due to their potential for high returns and diversification benefits. Among the various strategies available to mutual fund investors, Systematic Withdrawal Plan (SWP) has gained significant traction. An SWP allows investors to withdraw a fixed amount of money at regular intervals from their mutual fund investments. To optimize this strategy, investors often rely on an SWP Mutual Fund Calculator. This article delves into the intricacies of SWP, the importance of an SWP Mutual Fund Calculator, and how to use it effectively.

What is SWP?

A Systematic Withdrawal Plan (SWP) is a financial tool that allows investors to withdraw a predetermined amount of money from their mutual fund investments at regular intervals. These intervals can be monthly, quarterly, semi-annually, or annually, depending on the investor’s needs and the fund’s terms. SWP is particularly useful for retirees or individuals who require a steady income stream from their investments.

How Does SWP Work?

When an investor opts for an SWP, they specify the amount they wish to withdraw and the frequency of withdrawals. The mutual fund company then redeems the necessary number of units from the investor’s account to fulfill the withdrawal request. The remaining units continue to grow, potentially generating returns over time.

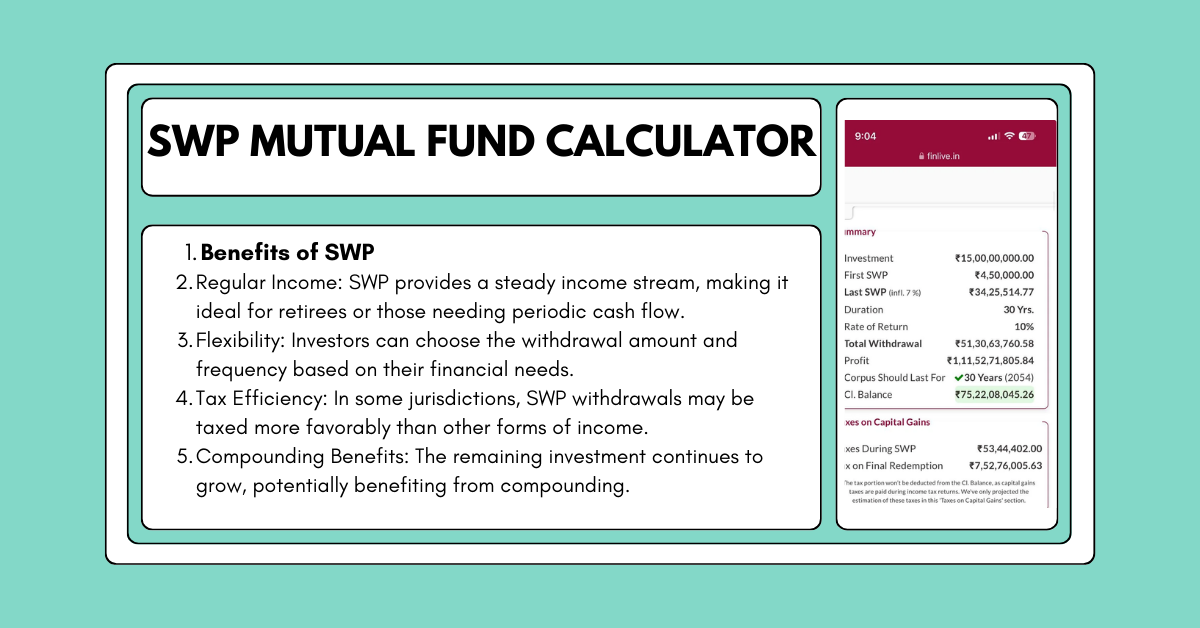

Benefits of SWP

- Regular Income: SWP provides a steady income stream, making it ideal for retirees or those needing periodic cash flow.

- Flexibility: Investors can choose the withdrawal amount and frequency based on their financial needs.

- Tax Efficiency: In some jurisdictions, SWP withdrawals may be taxed more favorably than other forms of income.

- Compounding Benefits: The remaining investment continues to grow, potentially benefiting from compounding.

The Need for an SWP Mutual Fund Calculator

What is an SWP Mutual Fund Calculator?

An SWP Mutual Fund Calculator is an online tool that helps investors estimate the amount they can withdraw periodically from their mutual fund investments while considering factors such as the initial investment amount, expected rate of return, withdrawal frequency, and investment duration.

Why Use an SWP Mutual Fund Calculator?

- Accurate Projections: The calculator provides precise estimates of withdrawals and the remaining corpus, helping investors plan their finances better.

- Scenario Analysis: Investors can test different scenarios by adjusting variables like withdrawal amount, frequency, and expected returns.

- Informed Decisions: By understanding the potential outcomes, investors can make more informed decisions about their SWP strategy.

- Time-Saving: Manual calculations can be time-consuming and prone to errors. The calculator simplifies the process, saving time and effort.

How to Use an SWP Mutual Fund Calculator

Step-by-Step Guide

- Enter Initial Investment: Input the total amount you have invested in the mutual fund.

- Select Withdrawal Frequency: Choose how often you wish to withdraw funds (monthly, quarterly, etc.).

- Enter Withdrawal Amount: Specify the amount you plan to withdraw each period.

- Input Expected Rate of Return: Estimate the annual return you expect from your mutual fund investment.

- Set Investment Duration: Define the period over which you plan to make withdrawals.

- Calculate: Click the calculate button to get the results.

Example Calculation

Let’s consider an example to illustrate how the SWP Mutual Fund Calculator works.

- Initial Investment: $100,000

- Withdrawal Frequency: Monthly

- Withdrawal Amount: $1,000

- Expected Rate of Return: 8% per annum

- Investment Duration: 10 years

Using the SWP Mutual Fund Calculator, the investor can determine the remaining corpus after 10 years of monthly withdrawals. The calculator will also show the total amount withdrawn and the impact of compounding on the remaining investment.

Factors Affecting SWP Calculations

1. Initial Investment Amount

The starting amount significantly influences the withdrawal capacity and the remaining corpus. A higher initial investment allows for larger or more frequent withdrawals.

2. Withdrawal Frequency and Amount

The frequency and amount of withdrawals directly impact the longevity of the investment. More frequent or larger withdrawals will deplete the corpus faster.

3. Expected Rate of Return

The anticipated return on the mutual fund investment plays a crucial role in determining the sustainability of the SWP. Higher returns can support larger withdrawals over a more extended period.

4. Investment Duration

The time horizon of the investment affects the total withdrawals and the remaining corpus. Longer durations allow for more withdrawals, but the corpus may deplete faster if withdrawals are substantial.

5. Market Volatility

Market fluctuations can impact the actual returns, deviating from the expected rate. It’s essential to consider market risks when planning an SWP.

Advantages of Using an SWP Mutual Fund Calculator

1. Financial Planning

The calculator aids in creating a robust financial plan by providing clear insights into the potential outcomes of an SWP strategy.

2. Risk Management

By understanding the impact of different variables, investors can manage risks better and adjust their strategies accordingly.

3. Goal Setting

Investors can set realistic financial goals based on the calculator’s projections, ensuring they meet their income needs without depleting their corpus prematurely.

4. Tax Planning

The calculator can help investors understand the tax implications of their withdrawals, allowing for more efficient tax planning.

Limitations of SWP Mutual Fund Calculators

1. Assumptions

Calculators rely on assumptions like expected returns, which may not always align with actual market performance.

2. Market Risks

Market volatility can lead to deviations from projected returns, affecting the sustainability of the SWP.

3. Inflation

Inflation can erode the purchasing power of withdrawals over time, a factor that may not be fully accounted for in the calculator.

4. Fees and Charges

Mutual funds may have associated fees and charges that can impact the net returns, which might not be fully reflected in the calculator.

Tips for Maximizing the Benefits of SWP

1. Regular Review

Periodically review your SWP strategy to ensure it aligns with your financial goals and market conditions.

2. Diversification

Diversify your mutual fund portfolio to mitigate risks and enhance returns.

3. Adjust Withdrawals

Be flexible with your withdrawal amounts and frequency based on changing financial needs and market performance.

4. Consult a Financial Advisor

Seek advice from a financial advisor to tailor your SWP strategy to your specific circumstances and goals.

An SWP Mutual Fund Calculator is an invaluable tool for investors looking to implement a Systematic Withdrawal Plan. It provides accurate projections, aids in financial planning, and helps manage risks effectively. However, it’s essential to recognize the calculator’s limitations and consider external factors like market volatility and inflation. By using the calculator wisely and regularly reviewing your strategy, you can maximize the benefits of SWP and achieve your financial goals.

Investing in mutual funds through an SWP can provide a steady income stream and financial security, especially during retirement. With the right approach and tools like the SWP Mutual Fund Calculator, you can navigate the complexities of mutual fund investments and make informed decisions that align with your long-term financial objectives.