SBI Mutual Fund Calculator

In the world of investing, mutual funds have emerged as one of the most popular investment vehicles, offering a balanced mix of risk and return. Among the myriad of mutual fund providers, SBI Mutual Fund stands out as a trusted name, backed by the State Bank of India, one of the largest and most reliable financial institutions in the country. To aid investors in making informed decisions, SBI Mutual Fund offers a powerful tool known as the SBI Mutual Fund Calculator. This article delves deep into the intricacies of the SBI Mutual Fund Calculator, exploring its features, benefits, and how it can be leveraged to optimize your investment strategy.

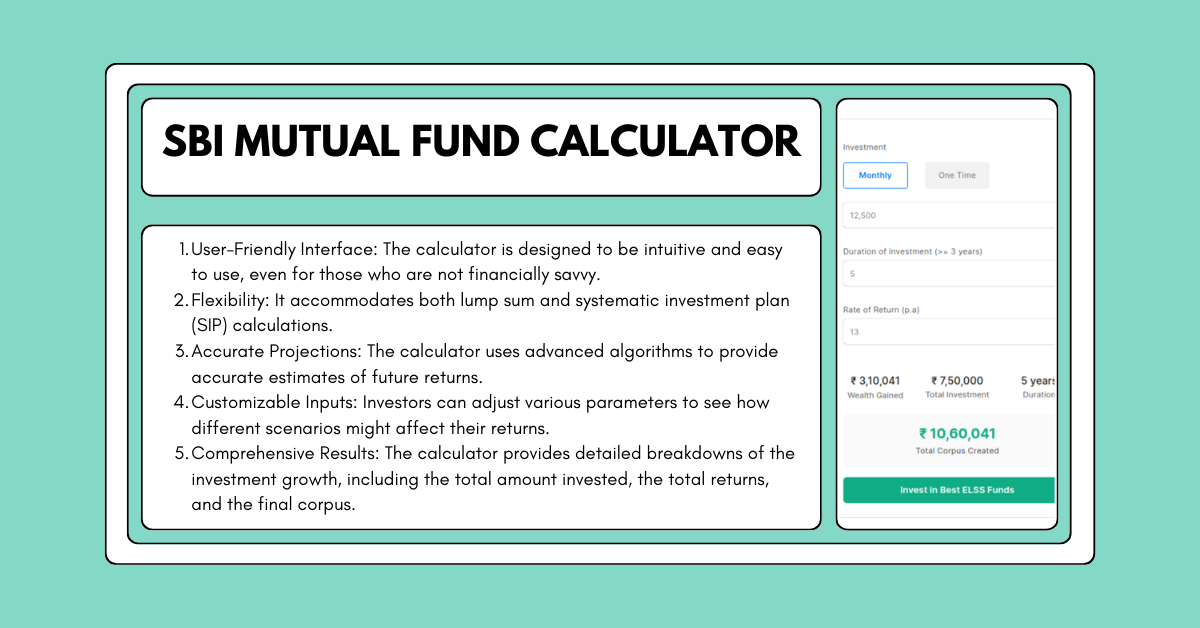

Key Features of the SBI Mutual Fund Calculator

- User-Friendly Interface: The calculator is designed to be intuitive and easy to use, even for those who are not financially savvy.

- Flexibility: It accommodates both lump sum and systematic investment plan (SIP) calculations.

- Accurate Projections: The calculator uses advanced algorithms to provide accurate estimates of future returns.

- Customizable Inputs: Investors can adjust various parameters to see how different scenarios might affect their returns.

- Comprehensive Results: The calculator provides detailed breakdowns of the investment growth, including the total amount invested, the total returns, and the final corpus.

Why Use the SBI Mutual Fund Calculator?

1. Financial Planning

One of the primary reasons to use the SBI Mutual Fund Calculator is to aid in financial planning. By providing a clear picture of potential returns, the calculator helps investors set realistic financial goals and plan their investments accordingly. Whether you’re saving for retirement, a child’s education, or a dream vacation, the calculator can help you determine how much you need to invest and for how long.

2. Risk Assessment

Investing in mutual funds involves a certain level of risk. The SBI Mutual Fund Calculator allows investors to assess the potential risks and rewards associated with different investment scenarios. By adjusting the expected rate of return, investors can see how changes in market conditions might impact their investments.

3. Comparison of Investment Options

The calculator enables investors to compare different mutual fund schemes and investment strategies. By inputting different parameters, investors can see how various schemes might perform over time, helping them make more informed decisions.

4. Time Value of Money

The SBI Mutual Fund Calculator takes into account the time value of money, which is a fundamental concept in finance. It recognizes that money available today is worth more than the same amount in the future due to its potential earning capacity. This is particularly important for long-term investments, where the compounding effect can significantly increase the value of the investment.

5. Goal-Based Investing

The calculator is an excellent tool for goal-based investing. Whether you’re aiming to buy a house, fund your child’s education, or build a retirement corpus, the calculator can help you determine how much you need to invest regularly to achieve your financial goals.

How to Use the SBI Mutual Fund Calculator

Using the SBI Mutual Fund Calculator is straightforward. Here’s a step-by-step guide:

Step 1: Choose the Type of Investment

The calculator offers two main options:

- Lump Sum Investment: A one-time investment where you invest a significant amount at once.

- Systematic Investment Plan (SIP): Regular investments made at fixed intervals (monthly, quarterly, etc.).

Step 2: Enter the Investment Amount

For a lump sum investment, enter the total amount you plan to invest. For SIP, enter the amount you intend to invest at each interval.

Step 3: Select the Investment Duration

Input the number of years you plan to stay invested. The longer the duration, the greater the potential for compounding to work in your favor.

Step 4: Input the Expected Rate of Return

Enter the expected annual rate of return. This can be based on historical performance data of the mutual fund scheme you’re considering or your own expectations.

Step 5: Review the Results

Once you’ve entered all the necessary information, the calculator will provide an estimate of the future value of your investment. It will also show a detailed breakdown, including the total amount invested, the total returns, and the final corpus.

Benefits of Using the SBI Mutual Fund Calculator

1. Informed Decision-Making

The calculator empowers investors with the information they need to make informed decisions. By providing a clear picture of potential returns, it helps investors choose the right mutual fund scheme that aligns with their financial goals.

2. Time-Saving

Manually calculating the potential returns on mutual fund investments can be time-consuming and complex. The SBI Mutual Fund Calculator simplifies this process, providing quick and accurate results in just a few clicks.

3. Customization

The calculator allows for a high degree of customization. Investors can adjust various parameters to see how different scenarios might affect their returns. This flexibility is particularly useful for those who are still exploring different investment options.

4. Transparency

The SBI Mutual Fund Calculator provides transparent and detailed results, helping investors understand exactly how their investments are expected to grow over time. This transparency builds trust and confidence in the investment process.

5. Goal Achievement

By helping investors set realistic financial goals and providing a clear roadmap to achieve them, the calculator plays a crucial role in goal-based investing. Whether you’re saving for a short-term goal or planning for long-term financial security, the calculator can help you stay on track.

Understanding the Results

The SBI Mutual Fund Calculator provides a detailed breakdown of the investment growth. Here’s what each component means:

1. Total Investment

This is the total amount of money you will have invested over the investment period. For a lump sum investment, it’s the initial amount. For SIP, it’s the sum of all the regular investments made over the years.

2. Total Returns

This is the total profit you can expect to earn from your investment. It’s calculated by subtracting the total investment from the final corpus.

3. Final Corpus

This is the total value of your investment at the end of the investment period. It includes both the principal amount and the returns earned.

4. Graphical Representation

Many calculators also provide a graphical representation of the investment growth over time. This visual aid can help investors better understand how their investments are expected to grow.

Factors Affecting Mutual Fund Returns

While the SBI Mutual Fund Calculator provides a useful estimate of potential returns, it’s important to remember that mutual fund investments are subject to market risks. Several factors can influence the actual returns, including:

1. Market Conditions

The performance of mutual funds is closely tied to the overall market conditions. Economic factors, geopolitical events, and market sentiment can all impact the returns.

2. Fund Management

The expertise of the fund manager plays a crucial role in the performance of a mutual fund. A skilled manager can navigate market volatility and make informed investment decisions that maximize returns.

3. Expense Ratio

The expense ratio is the annual fee charged by the mutual fund for managing the investment. A higher expense ratio can eat into the returns, so it’s important to choose funds with a reasonable expense ratio.

4. Investment Duration

The length of time you stay invested can significantly impact the returns. Longer investment durations allow for the power of compounding to work in your favor, potentially leading to higher returns.

5. Asset Allocation

The allocation of assets within the mutual fund (equity, debt, etc.) can also affect the returns. Different asset classes have different risk and return profiles, so it’s important to choose a fund that aligns with your risk tolerance and investment goals.

Tips for Using the SBI Mutual Fund Calculator Effectively

1. Set Realistic Expectations

While the calculator provides an estimate of potential returns, it’s important to set realistic expectations. Mutual fund investments are subject to market risks, and actual returns may vary.

2. Regularly Review Your Investments

Market conditions and personal financial goals can change over time. Regularly reviewing your investments and adjusting your strategy as needed can help you stay on track to achieve your financial goals.

3. Diversify Your Portfolio

Diversification is a key strategy for managing risk. By investing in a mix of different mutual fund schemes, you can spread your risk and potentially enhance your returns.

4. Consider Tax Implications

Mutual fund investments are subject to taxes, which can impact the overall returns. It’s important to consider the tax implications when planning your investments.

5. Seek Professional Advice

While the SBI Mutual Fund Calculator is a powerful tool, it’s always a good idea to seek professional financial advice. A financial advisor can help you create a customized investment strategy that aligns with your financial goals and risk tolerance.

The SBI Mutual Fund Calculator is an invaluable tool for anyone looking to invest in mutual funds. It provides a clear and accurate estimate of potential returns, helping investors make informed decisions and plan their finances more effectively. Whether you’re a seasoned investor or just starting out, the calculator can help you navigate the complex world of mutual fund investments with confidence.

By understanding how to use the calculator effectively and considering the various factors that can impact your returns, you can optimize your investment strategy and work towards achieving your financial goals. Remember, while the calculator provides a useful estimate, mutual fund investments are subject to market risks, and it’s important to regularly review your investments and seek professional advice when needed.

In the ever-changing landscape of financial markets, tools like the SBI Mutual Fund Calculator empower investors to take control of their financial future. So, whether you’re planning for retirement, saving for a big purchase, or simply looking to grow your wealth, the SBI Mutual Fund Calculator is a resource you can’t afford to overlook. Happy investing!