SBI Loan Calculator

State Bank of India (SBI), one of the largest and most trusted banks in India, offers a wide range of loan products to meet the diverse financial needs of its customers. Whether you are planning to buy a home, a car, or need funds for personal expenses, SBI has a loan product tailored for you. However, before applying for a loan, it is crucial to understand the financial implications, including the monthly EMI (Equated Monthly Installment), interest rates, and the total repayment amount. This is where the SBI Loan Calculator comes into play.

In this comprehensive guide, we will delve into everything you need to know about the SBI Loan Calculator, including its features, benefits, how to use it, and why it is an essential tool for anyone considering an SBI loan.

1. What is the SBI Loan Calculator?

The SBI Loan Calculator is an online tool provided by the State Bank of India to help potential borrowers estimate their monthly EMI, total interest payable, and the overall cost of the loan. It is a user-friendly and efficient tool that simplifies the loan planning process by providing instant calculations based on the inputs provided by the user.

The calculator is designed to cater to various types of loans, including home loans, personal loans, car loans, education loans, and gold loans. By using this tool, borrowers can make informed decisions about their loan applications and choose a repayment plan that aligns with their financial capabilities.

2. Types of Loans Offered by SBI

Before diving into the specifics of the SBI Loan Calculator, it is essential to understand the different types of loans offered by SBI. Each loan product has its unique features, interest rates, and eligibility criteria.

a) Home Loans

SBI offers home loans to individuals looking to purchase, construct, or renovate a residential property. The bank provides competitive interest rates, flexible repayment tenures, and additional benefits such as interest concessions for women borrowers.

b) Personal Loans

SBI personal loans are unsecured loans that can be used for various purposes, such as medical emergencies, weddings, travel, or debt consolidation. These loans are disbursed quickly and do not require collateral.

c) Car Loans

SBI car loans are designed to help individuals purchase new or used cars. The bank offers attractive interest rates, minimal documentation, and flexible repayment options.

d) Education Loans

SBI education loans are aimed at students pursuing higher education in India or abroad. The bank provides loans covering tuition fees, accommodation, and other related expenses. Repayment typically begins after the completion of the course.

e) Gold Loans

SBI gold loans allow borrowers to avail funds by pledging their gold ornaments or coins as collateral. These loans are ideal for individuals who need immediate funds for short-term financial needs.

3. How Does the SBI Loan Calculator Work?

The SBI Loan Calculator operates on a simple principle: it uses the loan amount, interest rate, and tenure to calculate the EMI and other loan-related details. Here’s a closer look at how it works:

a) Key Inputs Required

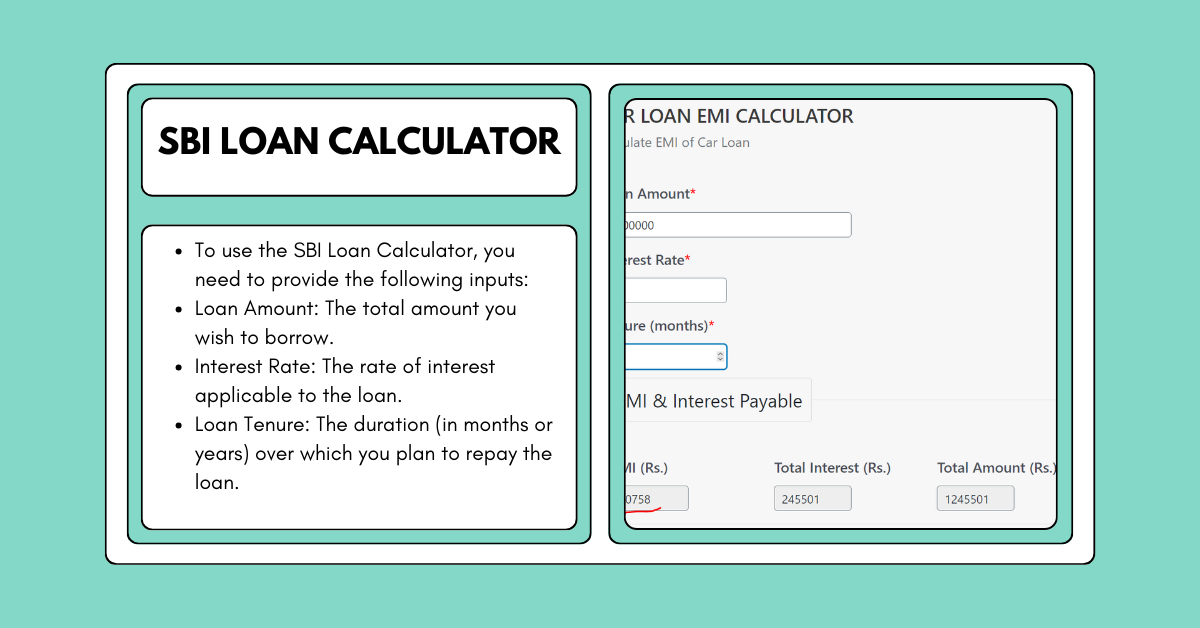

To use the SBI Loan Calculator, you need to provide the following inputs:

- Loan Amount: The total amount you wish to borrow.

- Interest Rate: The rate of interest applicable to the loan.

- Loan Tenure: The duration (in months or years) over which you plan to repay the loan.

b) Formula Used for Calculation

The SBI Loan Calculator uses the following mathematical formula to calculate the EMI:���=�×�×(1+�)�(1+�)�−1EMI=(1+r)n−1P×r×(1+r)n

Where:

- �P = Principal loan amount

- �r = Monthly interest rate (annual interest rate divided by 12)

- �n = Loan tenure in months

For example, if you take a home loan of ₹50 lakhs at an interest rate of 8% for a tenure of 20 years, the EMI would be calculated as follows:���=50,00,000×0.00667×(1+0.00667)240(1+0.00667)240−1=₹41,822EMI=(1+0.00667)240−150,00,000×0.00667×(1+0.00667)240=₹41,822

4. Benefits of Using the SBI Loan Calculator

The SBI Loan Calculator offers several advantages to borrowers, making it an indispensable tool for loan planning. Here are some of the key benefits:

a) Accurate Financial Planning

The calculator provides precise EMI estimates, helping borrowers plan their monthly budgets effectively. It also gives a clear picture of the total interest payable over the loan tenure, enabling borrowers to assess the affordability of the loan.

b) Time-Saving

Manual calculations can be time-consuming and prone to errors. The SBI Loan Calculator simplifies the process by delivering instant results, saving borrowers valuable time.

c) Comparison of Loan Options

Borrowers can use the calculator to compare different loan options by adjusting the loan amount, interest rate, and tenure. This helps in choosing the most suitable loan product.

d) Transparency in Loan Repayment

The calculator provides a detailed breakdown of the EMI, including the principal and interest components. This transparency helps borrowers understand how their payments are allocated over the loan tenure.

5. Step-by-Step Guide to Using the SBI Loan Calculator

Using the SBI Loan Calculator is a straightforward process. Here’s a step-by-step guide:

a) Accessing the Calculator

- Visit the official SBI website.

- Navigate to the “Loans” section.

- Select the type of loan you are interested in (e.g., home loan, personal loan).

- Click on the “Loan Calculator” option.

b) Entering Loan Details

- Enter the loan amount you wish to borrow.

- Input the applicable interest rate.

- Specify the loan tenure in months or years.

c) Interpreting the Results

Once you enter the required details, the calculator will display the following information:

- Monthly EMI: The amount you need to pay each month.

- Total Interest Payable: The total interest you will pay over the loan tenure.

- Total Payment: The sum of the principal amount and total interest.

6. Factors Affecting Loan EMI

Several factors influence the EMI calculated by the SBI Loan Calculator. Understanding these factors can help you make informed decisions:

a) Loan Amount

The higher the loan amount, the higher the EMI. Borrowers should only borrow what they can comfortably repay.

b) Interest Rate

A lower interest rate results in a lower EMI. It is advisable to compare interest rates offered by different lenders before finalizing a loan.

c) Loan Tenure

A longer tenure reduces the EMI but increases the total interest payable. Conversely, a shorter tenure increases the EMI but reduces the overall interest burden.

7. Tips to Reduce Your Loan EMI

Here are some practical tips to lower your loan EMI:

a) Opt for a Longer Tenure

Extending the loan tenure can significantly reduce your monthly EMI. However, this also means paying more interest over time.

b) Negotiate for Lower Interest Rates

Borrowers with a good credit score can negotiate with the bank for a lower interest rate, thereby reducing the EMI.

c) Make a Higher Down Payment

A larger down payment reduces the loan amount, leading to a lower EMI.

8. Common Mistakes to Avoid While Using the SBI Loan Calculator

To ensure accurate results, avoid these common mistakes:

a) Incorrect Loan Amount

Always enter the exact loan amount you wish to borrow. Overestimating or underestimating can lead to inaccurate EMI calculations.

b) Ignoring Processing Fees

Processing fees and other charges are not included in the calculator. Be sure to account for these additional costs.

c) Overlooking Prepayment Options

Some loans allow prepayment, which can reduce the total interest payable. Check if your loan offers this feature.

9. Frequently Asked Questions (FAQs)

Q1. Is the SBI Loan Calculator free to use?

Yes, the SBI Loan Calculator is a free online tool available on the SBI website.

Q2. Can I use the calculator for all types of SBI loans?

Yes, the calculator can be used for home loans, personal loans, car loans, education loans, and gold loans.

Q3. How accurate is the SBI Loan Calculator?

The calculator provides highly accurate results based on the inputs provided. However, the actual EMI may vary slightly due to rounding off or additional charges.

The SBI Loan Calculator is an invaluable tool for anyone considering an SBI loan. It simplifies the loan planning process, provides accurate EMI estimates, and helps borrowers make informed decisions. By understanding how to use the calculator effectively and considering the factors that influence loan EMIs, you can choose a loan product that best suits your financial needs.

Whether you are planning to buy your dream home, finance your child’s education, or purchase a car, the SBI Loan Calculator ensures that you are well-prepared to manage your loan repayments without any financial stress. So, the next time you consider applying for an SBI loan, make sure to use the SBI Loan Calculator to plan your finances wisely.