Sbi PPF Calculator

Public Provident Fund (PPF) is one of the most popular long-term investment schemes in India, offering attractive interest rates and tax benefits. The State Bank of India (SBI), being one of the largest public sector banks in the country, provides a convenient way to open and manage PPF accounts. To help investors plan their investments better, SBI offers an online PPF calculator. This article delves into the intricacies of the SBI PPF calculator, its benefits, how to use it, and why it is an essential tool for anyone looking to invest in PPF.

What is a PPF Account?

Overview of PPF

The Public Provident Fund (PPF) is a government-backed savings scheme introduced in India in 1968. It is designed to encourage savings and provide a secure investment option with tax benefits. The PPF account has a maturity period of 15 years, which can be extended in blocks of 5 years. The interest rate on PPF is set by the government and is subject to quarterly revisions.

Key Features of PPF

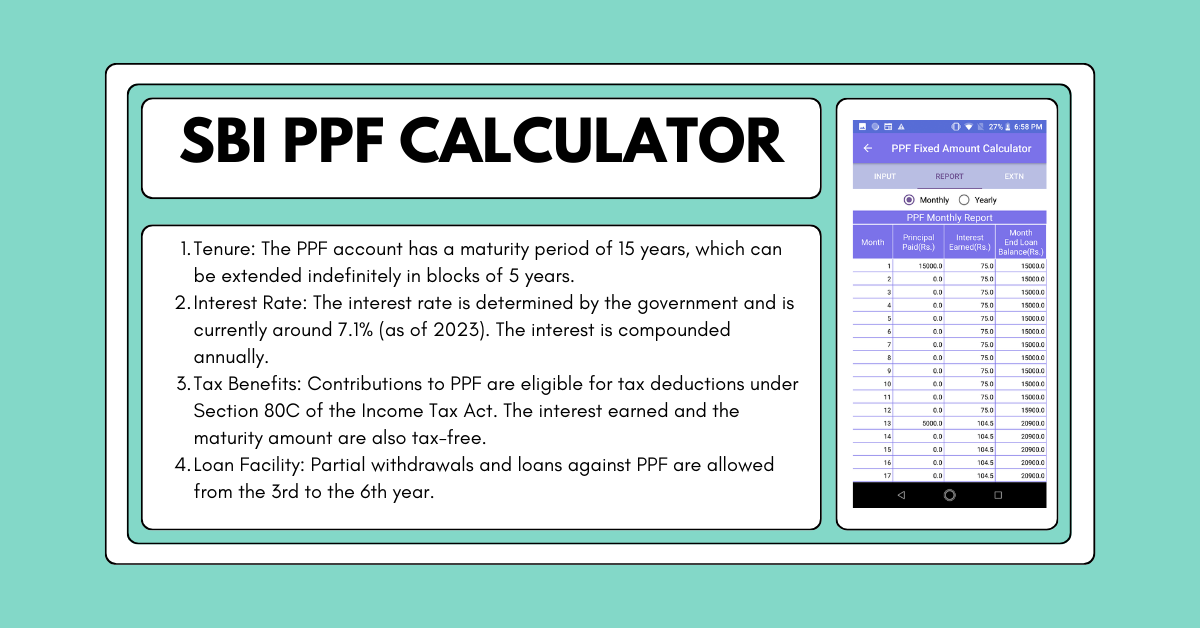

- Tenure: The PPF account has a maturity period of 15 years, which can be extended indefinitely in blocks of 5 years.

- Interest Rate: The interest rate is determined by the government and is currently around 7.1% (as of 2023). The interest is compounded annually.

- Tax Benefits: Contributions to PPF are eligible for tax deductions under Section 80C of the Income Tax Act. The interest earned and the maturity amount are also tax-free.

- Loan Facility: Partial withdrawals and loans against PPF are allowed from the 3rd to the 6th year.

- Minimum and Maximum Investment: The minimum annual investment is ₹500, and the maximum is ₹1.5 lakh.

What is the SBI PPF Calculator?

Definition

The SBI PPF calculator is an online tool provided by the State Bank of India to help investors estimate the returns on their PPF investments. It takes into account the principal amount, the tenure of the investment, and the prevailing interest rate to calculate the maturity amount.

Purpose

The primary purpose of the SBI PPF calculator is to provide investors with a clear picture of their investment growth over time. It helps in financial planning by allowing users to experiment with different investment amounts and tenures to see how they affect the final maturity amount.

Benefits of Using the SBI PPF Calculator

1. Accurate Calculations

The SBI PPF calculator uses the compound interest formula to provide accurate calculations of the maturity amount. This eliminates the need for manual calculations, which can be prone to errors.

2. Financial Planning

By using the calculator, investors can plan their finances better. They can determine how much they need to invest annually to reach their financial goals.

3. Time-Saving

The calculator provides instant results, saving time that would otherwise be spent on manual calculations.

4. Flexibility

Investors can adjust the investment amount and tenure to see how it impacts the maturity amount. This flexibility helps in making informed investment decisions.

5. Transparency

The calculator provides a clear breakdown of the investment growth, including the total interest earned and the final maturity amount.

How to Use the SBI PPF Calculator

Step-by-Step Guide

- Access the Calculator: Visit the official SBI website and navigate to the PPF calculator section.

- Enter the Investment Amount: Input the amount you plan to invest annually in the PPF account. The minimum amount is ₹500, and the maximum is ₹1.5 lakh.

- Select the Tenure: Choose the tenure of your investment. The default tenure is 15 years, but you can extend it in blocks of 5 years.

- Enter the Interest Rate: The calculator will automatically populate the current interest rate, but you can adjust it if you expect changes in the future.

- Calculate: Click on the ‘Calculate’ button to get the results.

- Review the Results: The calculator will display the maturity amount, the total interest earned, and a year-wise breakdown of the investment growth.

Example Calculation

Let’s assume you plan to invest ₹1.5 lakh annually in a PPF account for 15 years at an interest rate of 7.1%.

- Annual Investment: ₹1.5 lakh

- Tenure: 15 years

- Interest Rate: 7.1%

Using the SBI PPF calculator, the maturity amount would be approximately ₹40.68 lakh, with a total interest earned of ₹18.18 lakh.

Factors Affecting PPF Returns

1. Interest Rate

The interest rate on PPF is determined by the government and is subject to change. Higher interest rates result in higher returns.

2. Investment Amount

The amount you invest annually directly impacts the maturity amount. The more you invest, the higher the returns.

3. Tenure

The longer the tenure, the more time your investment has to grow through compounding. Extending the tenure beyond 15 years can significantly increase the maturity amount.

4. Frequency of Investment

While the minimum investment is annual, investing smaller amounts more frequently (e.g., monthly) can also impact the final returns due to the power of compounding.

Advantages of Investing in PPF

1. Tax Benefits

PPF offers triple tax benefits under Section 80C of the Income Tax Act. The contributions, interest earned, and maturity amount are all tax-free.

2. Safety

PPF is a government-backed scheme, making it one of the safest investment options available.

3. Long-Term Savings

The 15-year tenure encourages long-term savings, which is beneficial for retirement planning or other long-term financial goals.

4. Loan Facility

PPF allows partial withdrawals and loans against the balance, providing liquidity in times of need.

5. Flexibility in Investment

Investors can choose to invest any amount between ₹500 and ₹1.5 lakh annually, providing flexibility based on their financial situation.

Limitations of PPF

1. Lock-in Period

The 15-year lock-in period can be a disadvantage for those who need liquidity in the short term.

2. Interest Rate Fluctuations

The interest rate on PPF is subject to change, which can affect the returns.

3. Maximum Investment Limit

The maximum annual investment limit of ₹1.5 lakh may not be sufficient for high-net-worth individuals looking to invest larger amounts.

4. No Premature Closure

Premature closure of the PPF account is only allowed under specific conditions, such as medical emergencies or higher education.

How to Open an SBI PPF Account

Eligibility Criteria

- Resident Individuals: Only resident individuals can open a PPF account. Non-resident Indians (NRIs) are not eligible.

- Minors: A PPF account can be opened in the name of a minor, but it must be operated by a guardian.

Documents Required

- Identity Proof: Aadhaar card, PAN card, passport, etc.

- Address Proof: Aadhaar card, utility bills, passport, etc.

- Photographs: Recent passport-sized photographs.

- Application Form: Duly filled PPF account opening form.

Steps to Open an SBI PPF Account

- Visit the Branch: Go to your nearest SBI branch.

- Fill the Application Form: Obtain and fill out the PPF account opening form.

- Submit Documents: Submit the required documents along with the application form.

- Make the Initial Deposit: Deposit the minimum amount of ₹500 to activate the account.

- Receive Account Details: Once the account is opened, you will receive the account details and passbook.

Online Management of SBI PPF Account

Internet Banking

SBI provides internet banking facilities for PPF account holders, allowing them to:

- Check Balance: View the current balance and transaction history.

- Make Deposits: Transfer funds from your SBI savings account to your PPF account.

- Download Statements: Download account statements for record-keeping.

Mobile Banking

SBI’s YONO app also allows PPF account holders to manage their accounts on the go. Features include:

- Balance Inquiry: Check the current balance.

- Fund Transfer: Transfer funds to the PPF account.

- Transaction History: View past transactions.

Frequently Asked Questions (FAQs)

1. Can I open a PPF account online with SBI?

No, you cannot open a PPF account online with SBI. You need to visit a branch to open the account.

2. What is the current interest rate on SBI PPF?

As of 2023, the interest rate on SBI PPF is 7.1%.

3. Can I extend my PPF account beyond 15 years?

Yes, you can extend your PPF account in blocks of 5 years after the initial 15-year tenure.

4. Is the interest on PPF taxable?

No, the interest earned on PPF is tax-free.

5. Can I withdraw money from my PPF account before maturity?

Partial withdrawals are allowed from the 7th year onwards. Premature closure is only allowed under specific conditions.

6. Can NRIs open a PPF account with SBI?

No, NRIs are not eligible to open a PPF account.

7. What is the minimum and maximum investment in SBI PPF?

The minimum annual investment is ₹500, and the maximum is ₹1.5 lakh.

8. Can I transfer my PPF account from another bank to SBI?

Yes, you can transfer your PPF account from another bank to SBI by submitting a transfer application form.

9. How often is the interest on PPF compounded?

The interest on PPF is compounded annually.

10. Can I have more than one PPF account?

No, an individual can only have one PPF account in their name.

The SBI PPF calculator is an invaluable tool for anyone looking to invest in the Public Provident Fund. It provides accurate calculations, helps in financial planning, and offers flexibility in experimenting with different investment scenarios. By understanding how to use the calculator and the various factors that affect PPF returns, investors can make informed decisions and maximize their investment growth.

PPF remains one of the most secure and tax-efficient investment options in India, and with the convenience of online management through SBI, it has become even more accessible. Whether you are planning for retirement, your child’s education, or any other long-term financial goal, the SBI PPF calculator can help you chart a clear path to achieving your objectives.

Investing in PPF through SBI not only ensures the safety of your funds but also provides the dual benefits of attractive returns and tax savings. So, take advantage of the SBI PPF calculator today and start planning for a secure financial future.